May 4th, 2020

After a decade of economic growth, we have entered a recession. Many companies are already switching to survival mode, dramatically reducing their budgets. Unfortunately, R&D, product development, and new manufacturing equipment budgets – which fund most 3D printing initiatives – will be some of the first reduced. With overall spending on 3D printing likely to contract this year, an already crowded industry comes under increased pressure to deliver value. We explore how this economic downturn will reshape the industrial 3D printing industry.

The 3D Printing Market

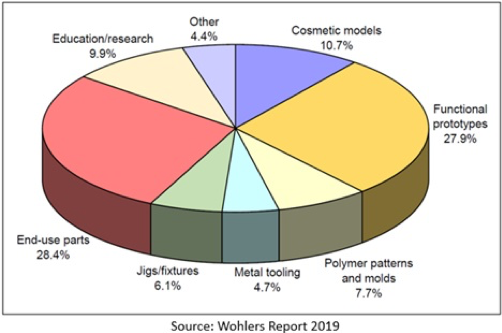

The industrial 3D printing market includes printers, printed parts, software, materials; and services include equipment maintenance and consulting work. There are many applications of these products and services which the Wohler’s report categorizes below:

Broken down more simply, there are three major categories of applications:

- Prototyping (cosmetic and functional)

- End-use parts

- Tooling (dies, molds, jigs, fixtures, and other manufacturing aids)

Industrial 3D printing consumption usually comes out of three budgets: R&D, product development, and manufacturing. R&D typically invests in 3D printing for evaluating new materials and processes, product development for prototyping, and manufacturing for tooling and end-use parts. Most companies reduce all three of these budgets during a recession, leading to decreased 3D printing consumption. But before we dive deeper into this depressing topic, let’s take a moment to appreciate the good times.

Good Times

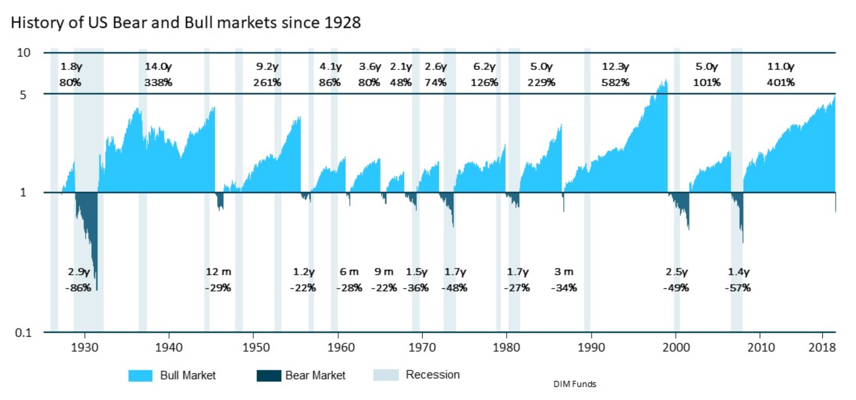

The global economy moves in cycles of expansion and contraction. Bull market expansions encourage corporate investment in R&D, new products, and upgrading manufacturing assets. Strategic initiatives like adopting new 3D printing technologies or growing current additive manufacturing capabilities rely on these types of corporate spending. We have just enjoyed one of the longest, largest bull markets in history with the S&P Index growing 400% over the past 11 years.

Economic expansions drive upticks in corporate spending and venture capital investment. In the last few years, over $3B of venture capital has flowed into the 3D printing companies, roughly equivalent to a quarter of the current size of the whole 3D printing market (source: pitchbook). This funding has launched many startups (ours included) and fueled the growth of existing 3D printing companies. In this last bull cycle, we have also seen established companies like GE, HP, and Xerox enter the industry with both acquisitions and their own technology development. In 2019 alone, 42 new industrial 3d printer OEMs emerged, an increase from 135 at the start of the year. 3D printing has become a fertile landscape of companies and technologies. This has been very inviting for customers to come and graze, but now a drought is setting in…

R.I.P. Good Times

https://www.sequoiacap.com/article/rip-good-times

While aspects of the pandemic present future opportunities for 3D printing companies to help digitize, shorten, and de-risk supply chains, the recession is certainly negative for near-term revenues. Venture capital is also starting to dry up. Most 3D printing companies recognize this and are already battening down the hatches, raising money where possible and reducing expenses. Most larger 3D printing companies have already done layoffs. You can read more about the adjustments that we made here: How Digital Alloys is Persevering Through the Pandemic. Companies know their optimal reaction should be proportionate to the future market conditions, but these are very hard to predict.

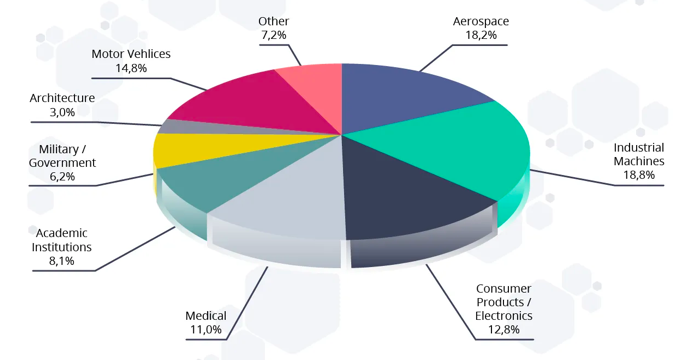

The sectors that consume the most industrial 3D printing are industrial/oil&gas, aerospace, automotive, consumer, and medical. With the potential exception of medical, all of these sectors are highly cyclical. The aerospace and oil & gas industries are especially damaged due to the current Coronavirus related travel restrictions (transportation is the largest consumer of oil).

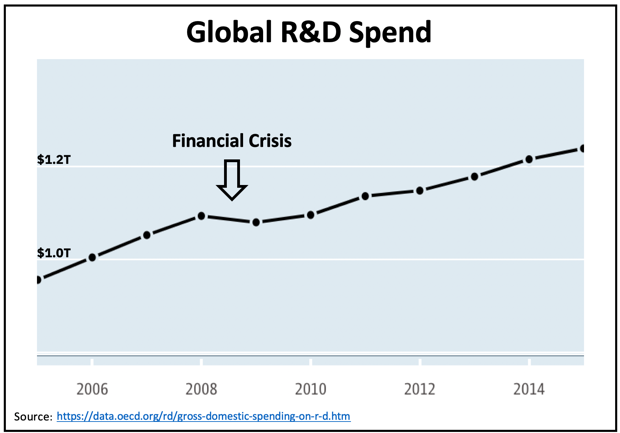

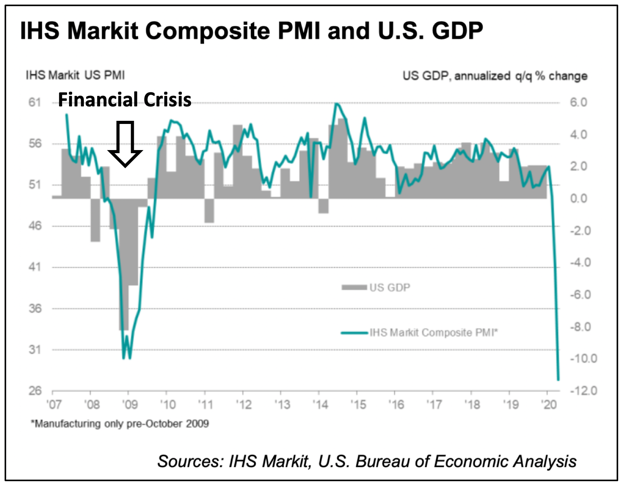

When revenues decrease, spend follows. The below charts illustrate the impact of the last recession on R&D and manufacturing activity, represented by the PMI index.

The IHS Markit Composite PMI (in the chart above) measures “changes in the working conditions of private companies in the manufacturing and service sectors.” It indicates a large reduction in current manufacturing activity. This is because the pandemic has constrained both supply and demand. While we are making progress reopening manufacturing facilities, uncertainty remains around overall economic demand. If consumers spend and travel less for an extended period of time it will have lasting impact on the automotive, commercial aerospace, and consumer products industries.

Sizing the Market Contraction

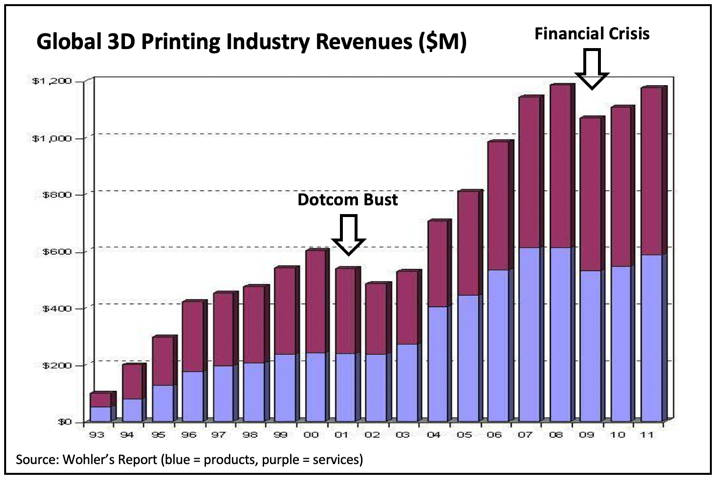

We can look to the past for clues on how to predict the extent of recessionary impacts on the 3D printing industry. In the most recent recessions of 2001 and 2008, 3D printing saw a 15-25% decline in total revenue, and this revenue didn’t recover for 2-3 years.

The depth and duration of the recession and the corresponding impact to the 3D printing industry largely hinges upon when people and businesses are able to start operating as they used to. The 3D printing industry has evolved significantly over the last decade and some of these changes provide reasons to be hopeful about its resilience:

- The industry is now more diversified across different technologies, materials, software, and applications

- There is increased adoption for tooling and end-use applications, which are less likely to see budget cuts vs prototyping (which was previously the vast majority of use cases)

- More companies have moved to recurring revenue models which provide revenue consistency

- Newer technologies such as Joule printing are more competitive with traditional manufacturing methods and are a viable solution for time and cost savings

- The industry has much more legitimate investment and momentum behind it now as most technologies and applications have passed Gartner’s figurative ‘peak of inflated expectations’ and are moving towards the ‘plateau of productivity’

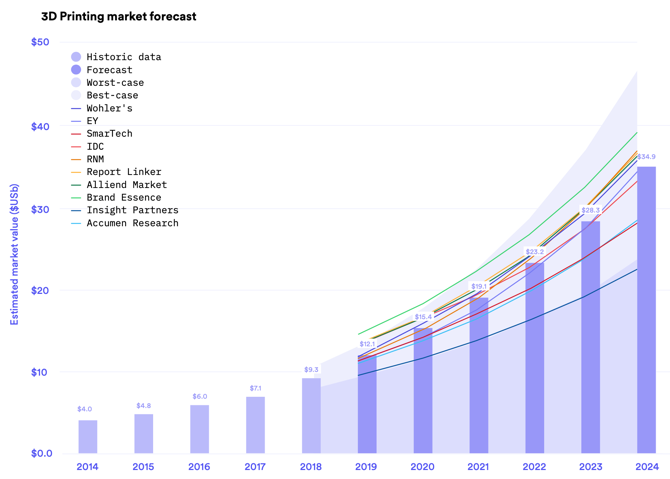

In January, 3D Hubs compiled the below industry revenue forecasts from various market research firms. Few of the models appear to factor in the economic slowdown we now face. We expect the near-term estimates to revise down by 5-20% as more data becomes available.

Conclusion

“You only find out who is swimming naked when the tide goes out”

- Warren Buffet

As the tide goes out on over a decade of record growth for the 3D printing industry, we are confronted with a vastly different commercial environment. The industry’s next phase will increasingly demand that technologies solve near-term business needs, and prove they can do so consistently, economically, and scalably. These business needs will emphasize cost and time savings, and the ability to digitize, shorten, and de-risk supply chains. Technologies and business models requiring complex, resource-heavy projects with long and uncertain ROI will likely take a back seat to simpler solutions with a fast-path to implementation. Commoditized products and services will face additional pricing pressures as differentiated technologies will be able to demand higher-margin, value-based pricing. The “fittest” companies, those that quickly adapt to the current environment to deliver viable, differentiated solutions to help their customers survive, will be rewarded with their own survival. These companies will be the ones that write the next chapter.

—-

Please join our mailing list to receive updates on future blog posts:

Please check out other posts in our blog series:

Digital Alloys’ Guide to Metal Additive Manufacturing

Learn about the technology behind our process:

Alex Huckstepp

VP Business Development

Digital Alloys is committed to providing the technology and expertise manufacturers need to use metal additive manufacturing in production — enabling them to save time, shrink costs, and produce valuable new product.